Mastering Market Trends with Python: A Comprehensive Guide to Implementing the Supertrend Indicator

Automate Your Trading Strategy with Python and Enhance Decision-Making Using the Supertrend Indicator

It's a lovely late afternoon, and you're scanning your TradingView chart setup, hoping to spot some promising signals. But instead, you're faced with ambiguous trends, feeling like you're trying to warp space-time with your mind. Frustration sets in because, unlike your friendly neighborhood grocer, the market isn't cooperating. We've all been there—it's tough. However, you can't force the market to work in your favor. Timing is crucial; sometimes, you just have to wait for the stars to align. This is where the Supertrend indicator proves invaluable. It helps analyze target markets, spotting trends and reversals, so you can make informed investment decisions. Consistency is key—more wins than losses. Knowing when to enter or exit the market is essential.

Why Use Python for This Implementation?

If you're familiar with Python, you know it's a versatile programming language with robust libraries designed for data analysis and visualization. Pandas, for instance, efficiently imports, cleans, and preprocesses market data, handling large datasets with ease—a vital feature when dealing with market data.

Numpy is another powerful library for financial analysis, offering extensive mathematical functions and tools for statistical calculations. These functions accelerate computations over large datasets, providing deeper insights in a short time compared to manual chart analysis.

Trading without bias and emotional sentiments is crucial for good investment decisions. This is why an algorithmic trading strategy can potentially lead to higher returns.

How Does the Supertrend Indicator Work?

Imagine a river that sometimes flows smoothly and at other times behaves erratically, even breaking its banks. This mirrors market behavior—prices can move smoothly or swing wildly, spiking unpredictably. The Supertrend indicator measures these swings, known as volatility, using the Average True Range (ATR). The ATR, representing the trading range of an asset over a specified period, helps generate the upper and lower bands—boundaries within which the asset prices fluctuate. A price break above the upper boundary signals an uptrend, while a break below the lower boundary signals a downtrend.

Calculating the Supertrend

To calculate the Supertrend, we first determine the ATR, a measure of volatility, over a specified period. Begin by calculating the True Range (TR) for each data point, which can be daily, hourly, or by minute, depending on your setup.

Next, calculate the ATR for a specified period, say 14 data points, representing the average of the TRs within that period.

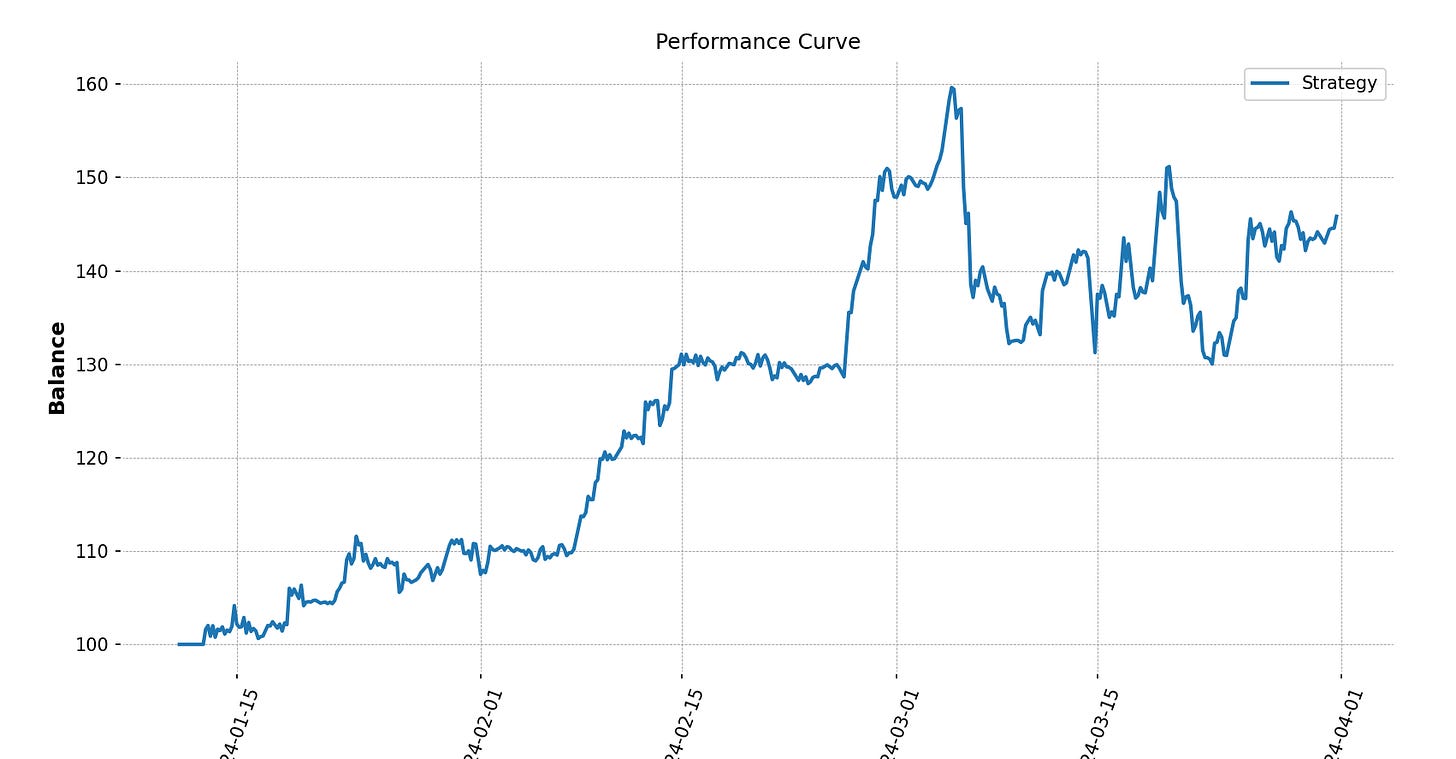

Here is the performance result of our strategy as a sneak-peak:

Now it is time to build this strategy and see how it achieves this performance with a simple Python implementation.

Python Implementation

Step 1: Prepare Your Coding Environment

Install Python 3 and the necessary libraries if you haven't already. Use the following command to install the required libraries:

Keep reading with a 7-day free trial

Subscribe to Quantitative Finance Insights to keep reading this post and get 7 days of free access to the full post archives.